Economic Indicators

Construction Faces Higher Costs, Weaker Jobs Amid PPI Downturn

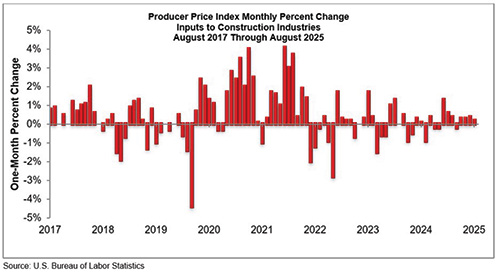

August PPI slipped overall, but metals and fuel pushed construction inputs higher

.webp?t=1758015785)

Iron and steel prices rose 9.2% year over year in August 2025, helping push overall construction input costs higher.

Construction materials costs climbed again in August, defying a broader decline in U.S. producer prices. The Bureau of Labor Statistics reported Sept. 10 that its Producer Price Index for final demand edged down 0.1% for the month.

Still, Associated Builders and Contractors’ analysis showed overall construction input prices increased 0.2%, with nonresidential inputs up the same amount. Year over year, construction materials costs rose 2.3%, led by a 9.2% jump in iron and steel and a 13.8% spike in copper wire and cable.

RELATED

Groups Blame Tariffs, Immigration Policies as Construction Loses 7K Jobs in August

“Construction materials prices rose modestly in August, although the increase would likely have been larger without declines in oil and natural gas,” ABC Chief Economist Anirban Basu said in a statement.

He added that despite inputs rising at a 5.3% annualized pace in 2025, contractors remain broadly optimistic about profit margins in the near term, according to ABC’s Construction Confidence Index

Labor Market Signals Economic Crosscurrents

Construction input prices posted a modest 0.2% increase in August 2025, continuing a trend of volatility seen since 2017. Source: U.S. Bureau of Labor Statistics

The PPI release came a day after BLS revised national employment data downward by 911,000 jobs for the 12 months through March 2025, halving previously reported payroll gains. The agency did not break out construction in that revision, though the industry’s recent performance suggests softness may extend into the sector.

BLS’ August jobs report, released Sept. 5, showed construction employment down by 7,000 positions, with residential specialty trades accounting for 5,200 of the losses. Only heavy and civil engineering added jobs, up 2,300 for the month

The revisions also underscored the political pressure on the agency. On Aug. 1, President Donald Trump sacked then-BLS Commissioner Erika McEntarfer following what the White House characterized as “fake” data in the July jobs report, as well as major downward revisions to the two months prior.

“In my opinion, today’s Jobs Numbers were RIGGED in order to make the Republicans, and ME, look bad,” the president posted on his Truth Social platform. Economists across the political spectrum decried the administration’s assertion as untrue and McEntarfer’s firing as capricious.

August data underscores diverging cost pressures. While energy prices fell—crude petroleum and natural gas each down 2.8%—metals and manufactured materials moved sharply higher. Aluminum mill shapes spiked 5.5% during the month, fabricated structural metal products rose and diesel fuel prices advanced, hitting heavy and civil projects directly.

Stage 4 intermediate demand, a category closely watched by economists because it reflects goods and services flowing into finished construction, rose 0.5% in August and is up 3.1% over the past year.

“Construction industry data have been particularly downbeat since March,” Basu said in a statement on the August jobs data. “With materials prices rising and construction spending shrinking, it’s hardly a surprise that the industry’s workforce is contracting.”

The divergence—falling overall producer prices but rising construction-specific input costs, alongside downward labor revisions—points to a volatile close to 2025 for builders navigating procurement, fuel expenses and staffing pressures.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!