Business Owners, Watch Out for those Mobile Deposits

No Company Needs to See a Check Cashed Twice

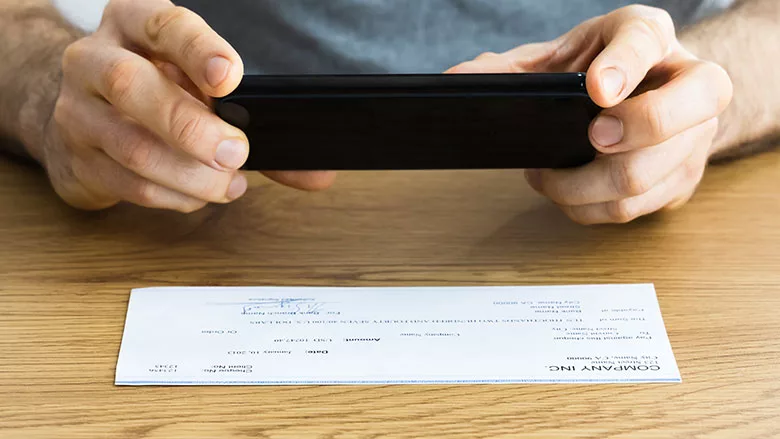

We all love the convenience of mobile deposit. As a business owner, did you know it means a vendor you paid (or even a scammer) could try to cash a check twice?

Source: Getty Images

This short story delves into something you probably never knew could happen.

Our company, Kingsland Drill International, a few years ago did a lot of business outside U.S. borders and clients would typically make payments via direct deposit to our account. At the time, I expected a letter of credit payment any day, so I checked our account online a couple of times a day.

One morning, as I leaned back in my chair sipping coffee, I checked the account, only to find it overdrawn by $30,000. Thirty thousand! How did this happen? I did not recall recently writing any $30,000 checks. Did someone hack my account? Had I received any deposits that might have been negated?

One morning, as I leaned back in my chair sipping coffee, I checked the account, only to find it overdrawn by $30,000. Thirty thousand! How did this happen?

I got out the checkbook and looked for any $30,000 checks. I found one sent out 6 months previously, but it was marked already returned. Had I not noticed it still out and the vendor had just cashed it now? I went to the bank statements. They showed the check deposited 6 months earlier.

I looked at the numbers and, shockingly, they matched. The bank cashed the same check twice. How did this happen and why did not the bank catch it? In response, the bank said it does not review incoming checks based on check number, and that the vendor had likely submitted it twice. When banks introduced us to the convenience of remote deposit, it opened the door to this possibility.

Think about it: When I go to the bank to make a deposit, I present the check. The bank marks it as deposited and physically returns it. Trying to submit a check marked “deposited” a second time? Impossible. With remote deposit, I still have the check. Nothing stops me from depositing it again.

I had to contact the vendor and ask him if he deposited the check twice. He told me the accounting department had a new person and that mistakes were made. That person, he added, was no longer with the company. I accepted that explanation but this scenario presented plenty of concerns.

First, if I actually had $30,000 in my account, it would have been gone. Could I have recovered it? Would I need to press fraud charges if the vendor did not cooperate? Second, the bank seemed not very concerned or helpful. I looked at my bank’s remote deposit and they make no mention of this possibility. Remote deposit is a choice of your vendor.

I had to devise a plan to check for duplicate check withdraws on my monthly bank statements. For a small company like ours, the process was not time consuming. But what if you write hundreds of checks a month to a multitude of vendors? Can we rely on memory when that second deposit comes months after the first?

I hope my accounting of this tale does more to bring attention to this possibility than to give shysters any ideas. Are you protected? Check with your bank to see how you can protect yourself.

For more Pipeline columns, visit www.thedriller.com/pipeline.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!